The previous evening’s storm clouds have cleared to bathe Tokyo in crisp sunshine. Tadashi Yanai, Japan’s richest man and the founder of $73 billion apparel empire Uniqlo, is perusing the art books that line his wood-paneled office, which, like most of his firm’s cavernous headquarters, commands sweeping vistas of the Sumida River. Finally, he retrieves one he believes will be of particular interest: a tome of historical photographs curated by TIME that features John F. Kennedy on the cover in deep conversation with his brother Bobby during the Cuban missile crisis.

[time-brightcove not-tgx=”true”]

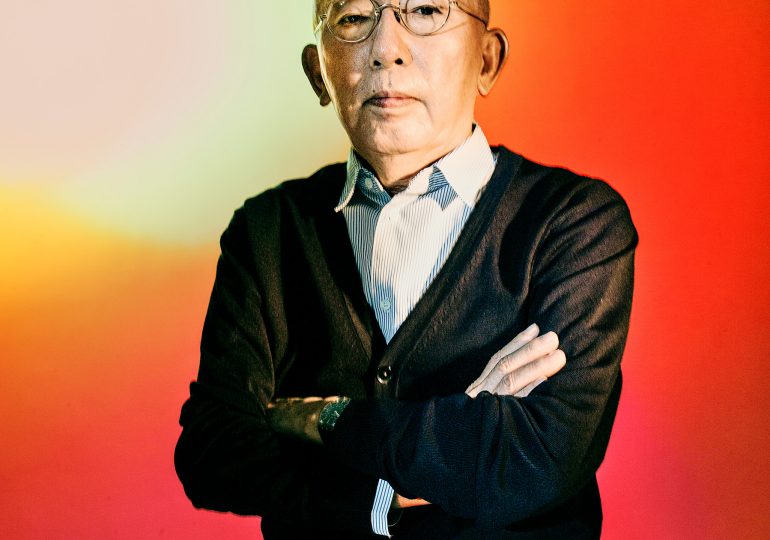

“I particularly like his saying ‘Ask not what your country can do for you—ask what you can do for your country,’” says Yanai, 74, carefully replacing the book in its stand. “That’s what I want to talk about today.”

On the face of it, Yanai has many reasons to feel upbeat. Fast Retailing—the holding company that operates Uniqlo and eight other brands he established out of his father’s tailoring business—saw operating profits of $2.54 billion for the year to Aug. 31, up 28.2% year over year. The firm’s share price, meanwhile, has soared 31% so far this year, propelling Yanai’s personal wealth to $36 billion. He also has bold plans to finally conquer the U.S. by nearly tripling Uniqlo’s existing 72 North American outlets by 2027.

The rosy outlook radiates across Japan, where a perennially sluggish economy is now predicted to grow faster than those of the U.S. and Europe, its bourse riding a three-decade high. Moreover, in response to the Ukraine war, Japan has pushed through a transformative increase in defense spending and in May welcomed world leaders for a G-7 summit in Hiroshima, galvanizing a resurgent leadership role for the world’s No. 3 economy. “The alliance between Japan and the United States is unprecedentedly strong and deep,” Prime Minister Fumio Kishida told TIME in late April.

Yet Yanai is not buying his nation’s new swagger. Instead, it’s time for some home truths, he says, insisting he wants to deliver a “shocking” statement to his compatriots. “Wake up!” he says squarely. “Japan is not an advanced nation at all, because we have been in a dormant state for 30 years.”

Yanai’s sobering pitch is that Japan’s economy is teetering on a precipice because of an unhealthy obsession with manufacturing, workers conditioned to corporate bloat, and a budget financed by soaring debt rather than tax receipts. In December, Japan’s Cabinet approved a record $858 billion general-account budget for 2023, despite expecting only $493 billion in tax revenue, with plans to issue $250 billion in new government bonds over the same period.

Japan’s public debt is already 264% of GDP—the highest in the world, and nominal wages (not adjusted for inflation) rose by just 4% from 1990 to 2019, compared with 145% in the U.S. Productivity languishes at the bottom of G-7 nations. “In Beijing and Shanghai, people are getting two and three times the compensation of equivalent positions in Japan,” says Yanai. “We need to normalize Japan’s economy.”

Yanai is putting his money where his mouth is and in March hiked the wages of Fast Retailing’s 8,400 or so employees in Japan by up to 40%. “That still is low; it should be much higher,” he confesses. He’s calling on Japan’s government to take similarly proactive measures such as raising interest rates, cutting handouts, and making sweeping regulatory changes to prevent the nation of 125 million from sleepwalking into disaster.

Fiscal lethargy is never a good look for a key U.S. ally, but especially not for one in the direct shadow of China, which Washington has come to regard not only as an economic competitor but also as a global rival. Still, Yanai’s rallying cry chafes with Japanese executives who owe their careers to steadily climbing the corporate ladder. Whether they will buy into his subversive fervor is a huge question.

Yanai isn’t coy about the stakes: “Unless we tap into the rest of the world, and become more active, there will be no future for the Japanese people.”

Yanai can’t help but swim against the tide. He’s a vibrant dynamo in a corporate culture famed for gray conformity and happily flaunts his success despite local taboos against ostentatious wealth—he owns two golf courses on Maui alone. Yanai has zero hesitation skewering the political elite when rival CEOs are more concerned by their stock price. “The Japanese government and bureaucrats need to have their mindsets challenged,” he says. “Because they know nothing.” But a man whose 2003 autobiography is titled One Win and Nine Losses cannot be accused of arrogance. His bootstraps ascension story has been one of struggles overcome, mistakes owned, self-doubt always lingering.

Hailing from the town of Ube in Yamaguchi prefecture, Yanai grew up in the cramped rooms above his parents’ shop, which sold off-the-rack suits. He studied political economy at Tokyo’s prestigious Waseda University but “graduated without going to any classes,” he says, because of a leftist student walkout that lasted 18 months. But the break in studies gave him the opportunity to travel to the U.S. and U.K., where the proliferation of mid-market clothing shops planted a seed that he would eventually sprout back home.

After a brief stint selling men’s clothes for a supermarket chain, Yanai was handed the keys to his father’s shop in 1972. But within two years, all the staff bar one had walked out because of frictions over his management style. (The only colleague to remain still works with him.) Still, the business grew steadily until, in 1984, Yanai established the first branch of the Unique Clothing Warehouse—later shortened to Uniqlo—in central Hiroshima. Uniqlo’s early success was rooted in a low price point combined with high-quality materials. Yanai doggedly experimented with new fabrics like the popular Heat-Tech range that retains warmth in winter while breathing in sweltering summers. The firm’s breakthrough came in 1998 when Yanai opened its first Tokyo outlet; its debut campaign was a lightweight fleece for just $15, which caused a sensation amid the cost-conscious post-bubble economy. Every fourth Japanese consumer bought one.

Yanai transformed his family’s tiny clothing store into an international phenomenon with more than 3,500 Fast Retailing stores across the world, including Uniqlo flagships in London’s Covent Garden, Milan’s Piazza Cordusio, and Fifth Avenue in New York City. Uniqlo has already overtaken Gap in terms of global reach and is fast hunting down Sweden’s H&M and Spain’s Zara. “My goal is to drive growth wherever possible,” insists Yanai.

Still, there have been blunders. In 2001, Uniqlo opened 21 stores in the U.K. only to shut 16 of them within two years after miserable results. In 2005, Uniqlo opened its first three U.S. stores in New Jersey, but all were closed by the following year. “We were nobody,” Yanai says. “The U.S. was my biggest failure.”

Yet he kept striving and evolving. Whereas his first billions were owed to plain, functional, durable clothing at minimal cost, today Uniqlo has moved up the value chain. It has design collaborations with the MOMA, Louvre, and Tate Modern as well as brand ambassadors including tennis superstar Roger Federer, who in 2018 signed a $30 million-per-year deal that tripled that of his previous sponsor, Nike.

For Yanai, the underlying philosophy is to fail rather than fade. He bears the scars from Ube, which was a coal-mining boomtown until the energy transition caused the pits to close and jobs to move elsewhere. As they did, all the shops that served them also shuttered. It was a grim lesson that every business plan has a shelf life and those that don’t adapt, perish.

Yanai’s passion for pushing boundaries is embodied by Uniqlo’s Tokyo headquarters, which sprawls over the size of a city block with 14-ft.-high ceilings, cafés, and hangout spaces. The R&D lab boasts test chambers where new materials are plunged into –40°C chills or torrential downpours as the wearer’s comfort is monitored via thermal-imaging cameras. In the basement are seven dedicated photo and video studios, where models parade next season’s lines and the color-corrected images are uploaded immediately to the firm’s website by technicians perched 10 ft. away. There’s a library overflowing with design books, and a Great Hall modeled on a sumo stadium whose polished timber bleachers can seat 1,000 for large presentations.

Everything is geared toward collaboration and control. Instead of simply entrusting overseas suppliers to replicate sample garments, Uniqlo maintains at great expense an Innovation Factory in Tokyo where it first finesses the entire manufacturing process. Ranks of 3D sewing machines—that can stitch complex garments from just one thread without seams, making them up to 40% more efficient—clatter away as production managers tinker with hundreds of variables to optimize quality and speed, down to the length and temperature of the post-manufacturing wash. Then the entire production manifest is sent to partner factories in Bangladesh or Vietnam that are equipped with identical machines and materials, ensuring precise replication even when production is ramped up by a factor of thousands. “It’s critical that quality goes together with fashion and functionality,” says Yanai.

Uniqlo’s agility and swelling global prominence run counter to the diminishing imprint of many storied Japanese firms. Up until the 2000s, Japan teemed with engineering pioneers: Casio invented the pocket calculator; Seiko the quartz wristwatch; Fujifilm the first digital camera. But in recent years, complacency, conservative leadership, and fierce competition have seen Japanese brands fall behind.

“Japanese businesses are managed as if they are looking in the rearview mirror,” says Yanai. “Japanese people need to come to terms with the reality that Japan is lagging behind other Asian countries.”

Many in Japan agree. Last year, Kishida unveiled plans to boost the number of startups in Japan tenfold by 2027 by helping entrepreneurs secure state or private funding. Just 0.08% of Japan GDP is invested in startups, compared with 0.64% in the U.S. and 2.61% in Israel.

Read More: Japan’s Most Popular Politician Wants to Bring His Analogue Country Into the Digital Age

A key barrier is psychological. Japan’s business culture is rooted in the concept of nemawashi, or “consensus building,” an informal process of quietly gathering support and feedback for any proposed project or directional shift. By contrast, Yanai’s leadership style is that of “a dictator,” says Yasushi Hasegawa, managing director of Tokyo-based business consultancy Fenetre Partners. “The biggest shortcoming of Japan is that there is no individuality,” says Yanai. “People need to stand on their own feet.”

Many in Japan wonder whether whoever succeeds Yanai will maintain the risk-taking ethos so pivotal to Uniqlo’s success. In 2002, Yanai handed the reins of Uniqlo to Genichi Tamatsuka, a former deputy, but returned as the firm’s president after three years, saying that Tamatsuka “wanted steady growth, but I want more transformation and growth.”

In August, Yanai again announced he was taking a step back from day-to-day operations, with Daisuke Tsukagoshi, formerly Uniqlo global CEO, becoming the brand’s executive director, president, and COO. The burning question is whether the post-Yanai Uniqlo retains his zeal for disruption and pushing boundaries. “Maybe Uniqlo will be a normal company after he dies,” suggests Hasegawa.

What Uniqlo can do for Japan, at least in its founder’s eyes, is clear. In this next phase, then, Yanai may be left asking what his country can do to Uniqlo.

Leave a comment